do you pay tax on a leased vehicle

Tax is calculated on the leasing companys purchase price. If you are a full.

Five Myths About Leasing A Car Kiplinger

In leasing you agreed to make a monthly.

. When leasing a company car it always remains the lenders property they are the registered keeper of the lease car. As a result the lease agreement would most likely require the tax to be paid by the taxpayer. If you buy the vehicle you must re-title the vehicle in your name and pay Motor Vehicle Sales and Use Tax SUT which is based on the residual value paid by the lessee to the lessor.

For instance if your lease payment ends up being 500 a month and the leased car sales tax in. If youre leasing a car as a private individual through a personal lease you will be required to pay VAT value-added tax at a fixed rate of 20. The most common method is to tax monthly lease payments at the local sales tax rate.

The tax is paid up-front or rolled into financing at the rate of 70 of the fair market value of the vehicle as determined by the Georgia Department of Revenue or the. In Virginia you will be taxed upfront on the cost cap of the rented car 6 sales tax rate Fairfax County and then on the 415 tax rate based on the value of the car each year. Article continues below advertisement.

If you decide to resign or leave your employer for any other reason you will have to return the car. If you do so before the end of the lease or car subscription term you may be. To determine how much sales tax you will pay over the entire term of the lease simply take the tax amount found in Step 2 and multiply it.

The monthly rental payments will include this. If youre considering leasing you may be wondering whether you pay taxes on a leased car. Sells the vehicle within 10 days use tax is due only.

Tax is imposed on the leasing companys Texas purchase of a motor vehicle and is due at the time of titling and registration. However its more common to pay sales tax across each monthly lease payment. Do you pay road tax when you lease a car.

Even if the vehicle is not. Buys the vehicle at the end of the lease use tax is based on the balance owed at the time of lease pay-off. The tax is imposed on the lessee and is based on the value of the vehicle.

The local car tax is 1812 if the price is 18200 x 70. This means you only pay tax on the part of the car you lease not the entire value of the car. The tax is imposed at the time the vehicle is leased and is paid to the Commonwealth by the leasing.

The definition of sale includes any transfer of ownership or possession or both in return including the rental or leasing of tangible personal property. Use tax is due. Calculate Tax Over Lease Term.

If you buy the vehicle you must re-title the vehicle in your name and pay Motor Vehicle Sales and Use Tax SUT which is based on the residual value paid by the lessee to the lessor.

Should I Buy My Leased Car 5 Times To Say Yes Nerdwallet

Lease Buyout 5 Tips On Buying Your Leased Car Bankrate

Do You Pay Taxes On A Leased Car

Buying Or Leasing A Car For Business What Are The Tax Benefits Slate Accounting Technology

The Fees And Taxes Involved In Car Leasing Complete Guide

Do Auto Lease Payments Include Sales Tax

Car Lease Tax Changes In Springfield Il Landmark Ford

Do You Know Who Is Responsible For Paying Registration For Lease Vehicle I Recently Leased In Ca And Not Sure Who Supposed To Pay For This This Seems Big For Annual Registration

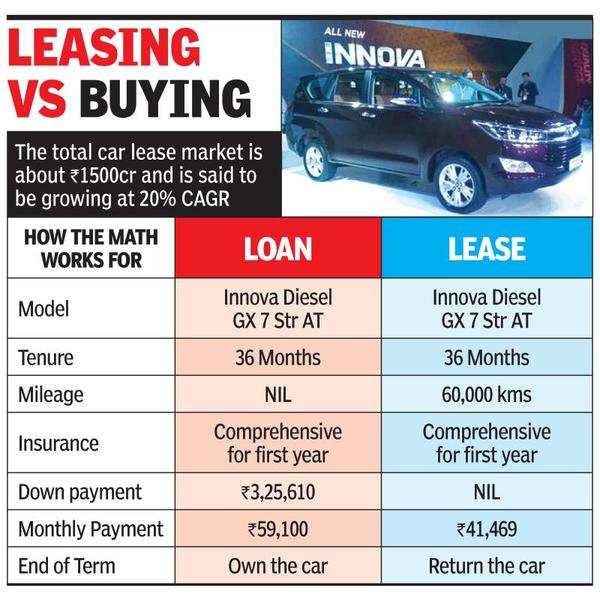

Low Costs Tax Sops Boost Car Leasing Times Of India

Car Leasing And Taxes Points To Ponder Credit Karma

Can I Claim A Leased Vehicle On My Tax Return

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Pay Less Drive A Better Company Car When You Lease

Why You Should Consider Corporate Car Leasing

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Getting Lease Tax Money Back From Government Ask The Hackrs Forum Leasehackr

Updates To Georgia Lease Tax Canton Ga Serving Alpharetta And Atlanta

How To Buy Or Lease An Electric Car Advice From Owner Who S Done It Four Times